税率在Excel VBA

下面我们就来看看在Excel VBA程序,计算上的收入税。以下税率适用于个人谁是澳大利亚的居民。

| Taxable income | Tax on this income |

|---|---|

|

0 – $6,000 |

Nil |

|

$6,001 – $35,000 |

15c for each $1 over $6,000 |

|

$35,001 – $80,000 |

$4,350 plus 30c for each $1 over $35,000 |

|

$80,001 – $180,000 |

$17,850 plus 38c for each $1 over $80,000 |

|

$180,001 and over |

$55,850 plus 45c for each $1 over $180,000 |

现状:

1.首先,我们声明两个double变量。一个双变量我们称之为收入,我们称之为税一个双变量。

Dim income As Double Dim tax As Double

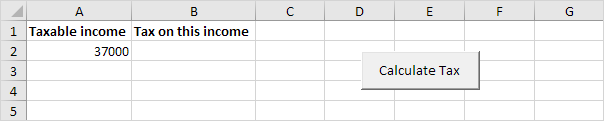

2.我们初始化变量收入与单元格A2的价值和圆形它。

income = Round(Range("A2").Value)

3.我们再次下修约值到单元格A2。

Range("A2").Value = income

选择案例声明来计算收入的征税。 Excel VBA中使用的收入来测试每个后续的Case语句,看是否Case语句下的代码应该被执行。

Select Case income Case Is >= 180001 tax = 55850 + 0.45 (income - 180000) Case Is >= 80001 tax = 17850 + 0.38 (income - 80000) Case Is >= 35001 tax = 4350 + 0.3 (income - 35000) Case Is >= 6001 tax = 0.15 (income - 6000) Case Else tax = 0 End Select

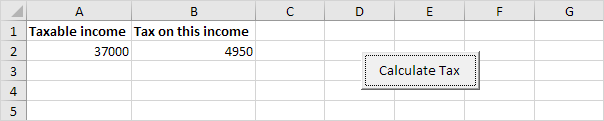

例如:如果收入37000,税等于4350 + 0.3 *(37000-35000)= 4350 + 600 = $ 4950 5.我们写可变税细胞B2的值。

Range("B2").Value = tax

6.将这个代码在一个命令按钮并进行测试。

结果: